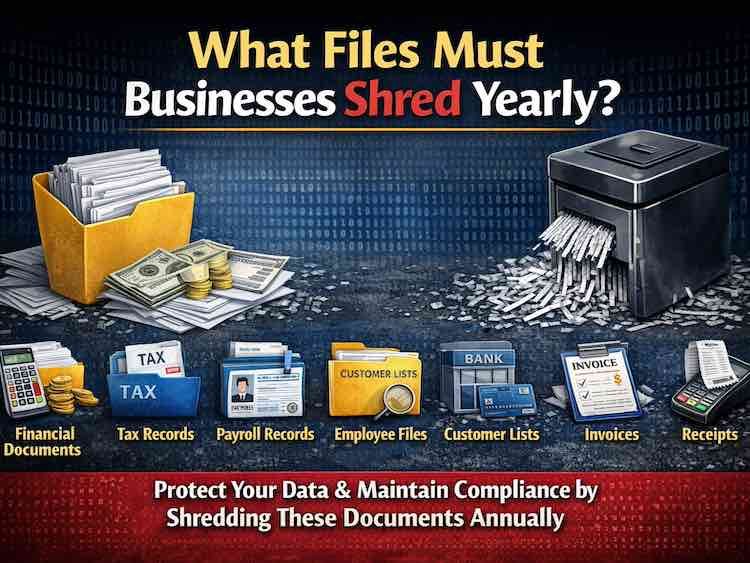

What Files Must Businesses Shred Yearly?

Keeping Sensitive Business Information Secure Year After Year

As a business owner, you already juggle countless responsibilities, but one that’s becoming more important than ever is protecting your company’s sensitive information. Whether it’s financial records, contracts, or your customers’ personal details, it’s up to you to make sure they are handled properly. Holding on to documents you no longer need or tossing them out the wrong way can open the door to identity theft, hefty fines, or even damage your reputation. Annual document shredding with a team of trusted professionals is an easy, stress-free way to stay compliant and keep sensitive information safe.

Shred These 5 File Types Annually

It’s common practice to tidy up the books and clean out files at the end of the year. However, with regulatory compliance requirements in place, not all legal and business documents can be shredded right away, as some must be stored for a longer period. Certain file types can and should be shredded annually.

Schedule an on-site or off-site document shredding appointment to get rid of these five file types:

- Financial records: These include bank statements, canceled checks, credit card statements, and invoices. Keep in mind that you generally want to keep three to seven years of tax records. Securely shredding these documents can safeguard your company from fraud and theft.

- Employee and human resources records: Consider the employees who have left your organization. There are W-2 forms, payroll records, performance reviews, and employment contracts. The IRS and labor laws will dictate how long you need to keep them. Shredding old employee records in a timely manner will ensure employee privacy and compliance.

- Legal and business documents: Every company will have some form of contracts, leases, agreements, permits, or licenses. Document retention policies may require some files to be kept long-term, while others can be shredded annually. Document destruction helps limit the risk of leaving outdated contracts and legal papers in accessible areas.

- Customer and client information: If you work with customers, you will have personal data, such as billing information and signed forms. Your company has a responsibility under privacy laws to protect its clients’ information. Annual shredding can help you prevent data breaches and maintain your customers’ trust.

- Marketing and miscellaneous files: There may be some records you haven’t considered shredding before. They include old mailing lists, expired promotions, and outdated research reports. They are less regulated, but they can still contain sensitive information that could put your business at risk if not properly destroyed.

Start the Year Secure, Organized, and Compliant

Yearly shredding will help your company meet compliance mandates and prevent data breaches. When you set up a regular shredding schedule with Crown Information Management, you can enjoy the peace of mind that comes from working with professionals. We offer secure document disposal by trained staff using specialized equipment designed to protect confidential information from start to finish.

Your business can choose the solution that best fits your workflow with our flexible on-site and off-site shredding options. Every service includes a Certificate of Destruction, providing documented proof for audits and compliance requirements. From paper shredding and records storage to hard drive and X-ray destruction, we support you and your business year in and year out.

To learn more about our shredding and information management services, call 800-979-9545 or contact us online. We are a SOC 1, NAID AAA, and PCI-certified company.