Serving Florida Since 2003

Experience The

Crown Difference

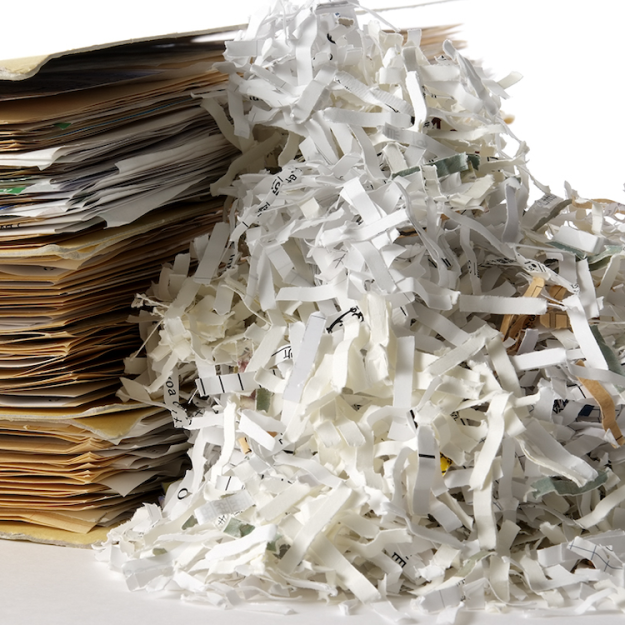

Crown Information Management is a Florida based, locally owned, and operated, secure information management service company, that has been servicing Florida since 2003. We provide a full line of shredding services, record storage, and scanning services.

Our goals are simple; to operate our services with the security and privacy our clients expect and to give you accurate assurances that our services, are at the forefront of best practices. At Crown Information Management, we recognize the value of partnering with our clients. We live, work, and play in your same community. We appreciate your business and will continue to provide you with outstanding service and security. Our commitment to your success, helps us achieve ours.

Serving Florida Since 2003

Experience The

Crown Difference

Crown Information Management is a Florida based, locally owned, and operated, secure information management service company, that has been servicing Florida since 2003. We provide a full line of shredding services, record storage, and scanning services.

Our goals are simple; to operate our services with the security and privacy our clients expect and to give you accurate assurances that our services, are at the forefront of best practices. At Crown Information Management, we recognize the value of partnering with our clients. We live, work, and play in your same community. We appreciate your business and will continue to provide you with outstanding service and security. Our commitment to your success, helps us achieve ours.

What Our Customers

Are Saying

Please take a moment to read through a few of the thank-you letters we’ve received from our customers. We are very proud to have earned such glowing remarks! At Crown information Management, we’re always interested in our customer’s thoughts.

I just wanted to let you know that your team was just here. They are FABULOUS!!! Wes was the technician and has been here before. Both gentlemen were totally professional and super nice. Please let them know. Thank you again!

The gentlemen were great this morning! I didn’t realize how fast the process was. If we ever need to shred again, we will certainly contact you. Thank you!

Crown Shredding is always a pleasure to work with. The ladies in the office are very nice and professional, the drivers are great, and I appreciate your quick responses to my questions and requests. Just wanted you to know – Thanks again!